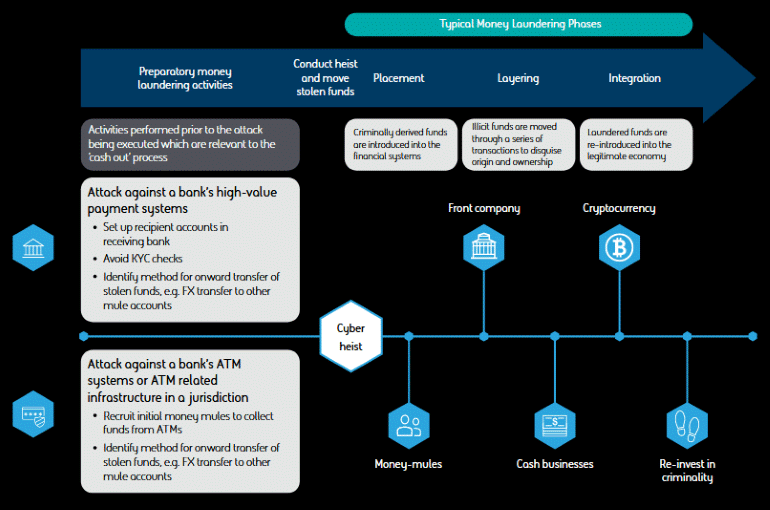

Specialists of the SWIFT organization, which operates same-named international system or the transfer of financial information, published a report on various money laundering techniques. As it turned out, money is rarely laundered using cryptocurrencies; criminals prefer shell companies, casinos, money mules and other “classic” methods.

The report states that most of the stolen bank funds are currently laundered using time-proven methods.

“These can be money mules, shell companies, cash deals, casinos, reverse investments in other forms of crime, and more”, – said SWIFT specialists.

It is worth talking about money mules separately, since there are many types of them. For example, such people can accept cybercriminals’ funds into their accounts and then send them to criminals; use fake documents to open accounts on behalf of hacker groups; collect money from ATMs; forward items purchased with stolen funds etc.

Speaking about rare cases of money laundering using cryptocurrencies, SWIFT experts give several examples.

So, in the first case, a certain criminal group attacked ATMs in order to cash out funds. The group then converted the stolen money into cryptocurrency, instead of using money mules to buy and resell expensive goods with this money, as usually happens.

In the second example, we are talking about another group from Eastern Europe, which has created its own bitcoin farm in East Asia. Criminals used funds stolen from banks to run a farm, mine bitcoins, and then spend bitcoins in Western Europe. When the members of the group were arrested, law enforcement officers seized 15,000 bitcoins worth USD 109 million, two sports cars and jewelry worth USD 557,000 from the gang leader’s home.

Another case involves the famous North Korean hack group Lazarus.

“The group stole money from banks, converted them into cryptocurrency, transferred these assets to different exchanges to hide their origin, and then converted back to fiat currency and sent it to North Korea”, – said SWIFT experts.

In addition, experts recorded a number of cases when hackers used funds stolen from banks to buy prepaid cryptocurrency cards.

Such debit cards can store cryptocurrency instead of fiat funds, and then, for example, they can be used in special ATMs for converting and withdrawing fiat money. SWIFT reports that several platforms in Europe and the UK were used to recharge prepaid cards with bitcoins, which were then spent on the purchase of jewelry, cars and other property.

Although cryptocurrency is rarely used for money laundering, experts believe that the number of such incidents will increase in future.

“This will be facilitated by the growing number of altcoins, which are focused on ensuring complete anonymity of transactions. In addition, criminals are increasingly using special mixers and tumblers. Such services help to hide the real source of cryptocurrency transactions by mixing stolen or laundered funds with the amounts of other legitimate transactions”, – consider the authors of the report.

SWIFT also notes that the emergence of marketplaces where users can register using only an email address and completely hiding their identity will play a role. These people can then buy high-value goods, land, and real estate from all over the world, that is, literally everything from expensive watches and jewelry to gold bars, art objects, luxury penthouses and tropical islands.

Let me remind you that recently the Ukrainian cyber police in cooperation with Binance detained operators of 20 cryptocurrency exchangers.